![]()

Ho, ho, ho and bottle of rum! Ahoy, it’s me again, your favorite app pirate. Me and my crew just had one of the best booty hunting adventures. We found lots of golds and treasures. We also take a break from sailing the sea once in a while and visit our landlubber friends for a short time. During those time, we enjoy by having party, eating out and drinking! Har, har, har. So you thought that sailing and treasure hunting are where our lives revolve in, aye? We exchange our gold with dollars so we have something to spend during our stay on land. In my recent vacation, I found this app called Pocket Expense Personal Finance – Account Tracker, Budget Planner & Bills by Appxy, which I used for budgeting. This is the app that we’ll be talking about in this review. Avast ye as we begin.

It Has Loads of Features

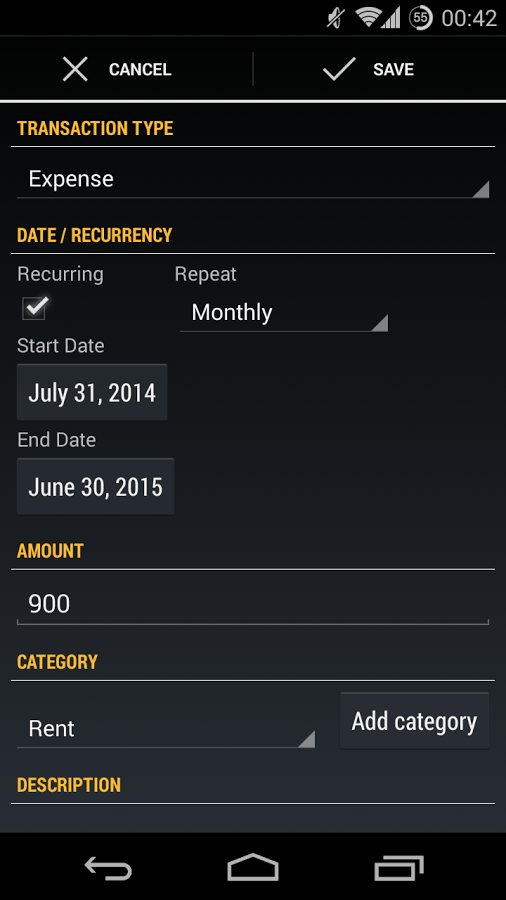

This app comes with several features that would help you in managing your personal finance. There are apps that were designed for creating budget, tracking account and paying bills. This one can provide all of these, which is convenient as you don’t have to use various apps. You can add various accounts, including bank account, credit cards and cash. Creating a budget is also easy as you can enter the amount that you wish to spend on different areas like food, clothing, entertainment, and utilities.

This app comes with several features that would help you in managing your personal finance. There are apps that were designed for creating budget, tracking account and paying bills. This one can provide all of these, which is convenient as you don’t have to use various apps. You can add various accounts, including bank account, credit cards and cash. Creating a budget is also easy as you can enter the amount that you wish to spend on different areas like food, clothing, entertainment, and utilities.

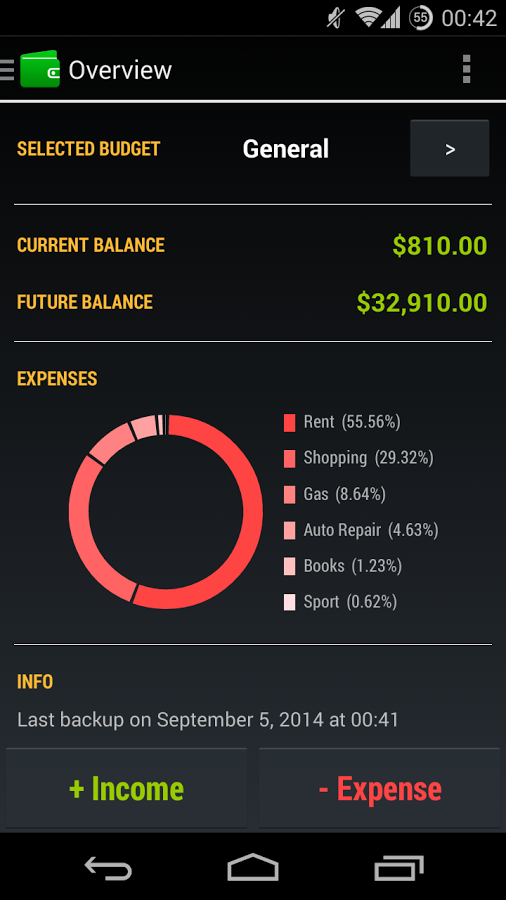

It Has a Basic Interface

Although it has several features, the developers were still able to make the interface simple and easy to understand and use. It’s straightforward so even if it’s your first time using it, it wouldn’t be difficult for you to navigate. For instance, the accounts would show you your list of income or sources and their balance, while budget would show you how much you can still spend for the different areas of your finances so you’ll know if you’re running short of cash on a specific area. You could quickly move budget from one area to another in order to keep everything balance.

Although it has several features, the developers were still able to make the interface simple and easy to understand and use. It’s straightforward so even if it’s your first time using it, it wouldn’t be difficult for you to navigate. For instance, the accounts would show you your list of income or sources and their balance, while budget would show you how much you can still spend for the different areas of your finances so you’ll know if you’re running short of cash on a specific area. You could quickly move budget from one area to another in order to keep everything balance.

It’s Free

Another good thing about this app is that it’s free. It’s nice how you can use all the features conveniently without having to spend anything. There’s a paid version that you can get through an in-app purchase if you wish to remove the advertisements that are shown on the free app.

The Good

As mentioned, a good thing about this app is that it has several features that you would find in different apps. It brings convenience as you can just use one app for all these features. It’s free so you can utilize it without shedding money and it could keep your budget on track.

The Bad

The free version comes with advertisements. Removing the ads would require you to make an in-app purchase. The Android version is also not available to all users as of this moment.

The Verdict

If you’re looking for a free app that you can use for managing your personal finance, this is an app to consider. It may come with ads, but it’s easy to use and it works as designed.